Your Guide to Life Insurance with Living Benefits

In this post, we explore different riders that can enhance your life insurance coverage with benefits you can use while living.

Learn more about life insurance with Quotacy’s expert-written and reviewed articles. From advice and tips to the difference between insurance types, we’ve got you covered. Explore insurance options, learn how to buy a policy, and read about what policy owners should know.

In this post, we explore different riders that can enhance your life insurance coverage with benefits you can use while living.

What you pay for life insurance is determined by your risk factors. In this blog post we explain what these life insurance risk factors are and how they affect your life insurance rates.

If you get the right policy, buying life insurance may be the best choice you ever make. Learn how to buy life insurance wisely in our step-by-step guide.

Life insurance can help protect your loved ones if you’re no longer around to do so. Learn the importance of life insurance for families.

Life insurance is an important buying decision because it directly affects your loved ones – make sure you understand what you’re getting. This True or False quiz will test your basic life insurance knowledge.

In this post, we explain what life insurance is and why you may need life insurance.

In this post, we explain what happens if you can’t afford to pay your life insurance premiums on time, or if you miss a payment.

In this post, we explain how life insurance protects newlyweds from the financial hardship death may bring.

Accidental death and dismemberment insurance plans are often very attractive at face value, but their gaps in coverage make them risky to rely on. We’ll walk you through what you need to know.

Although a 10-year term life insurance policy may not last very long, this post explains the situations in which it makes sense to purchase one.

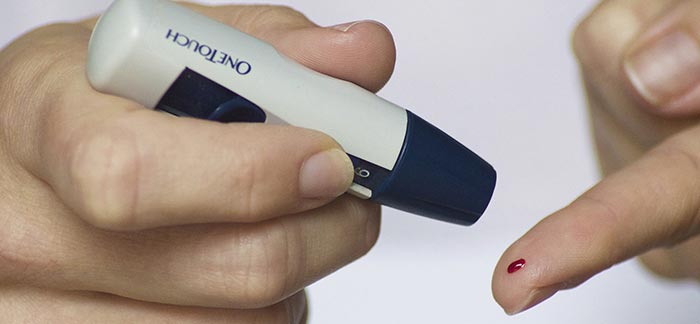

Being diabetic does not mean you can’t be approved for life insurance. In this post, we explain how diabetes can affect your life insurance rates.

The more common term policy lengths are 10, 20, and 30, but as we often say life insurance is not “one-size-fits-all”. For some lifestyles, there is the lesser known 25-year term length that sometimes fit just right.

In this post, we talk about the rights a child gains when they turn 18 and rights parents lose. We also explain important things a family should do before the 18th birthday.

In this post, we explain how risk classifications are assigned and how they impact what you end up paying for life insurance.

In this post, we talk about how affordable a $250,000 policy is and scenarios when it makes sense.