As women continue to break glass ceilings, why do we still lag behind when it comes to financial confidence and planning? While men remain the primary earners in most opposite-sex marriages, the percentage of women earning as much as or more than their husbands has roughly tripled over the past 50 years.

Despite this progress, women face unique financial challenges:

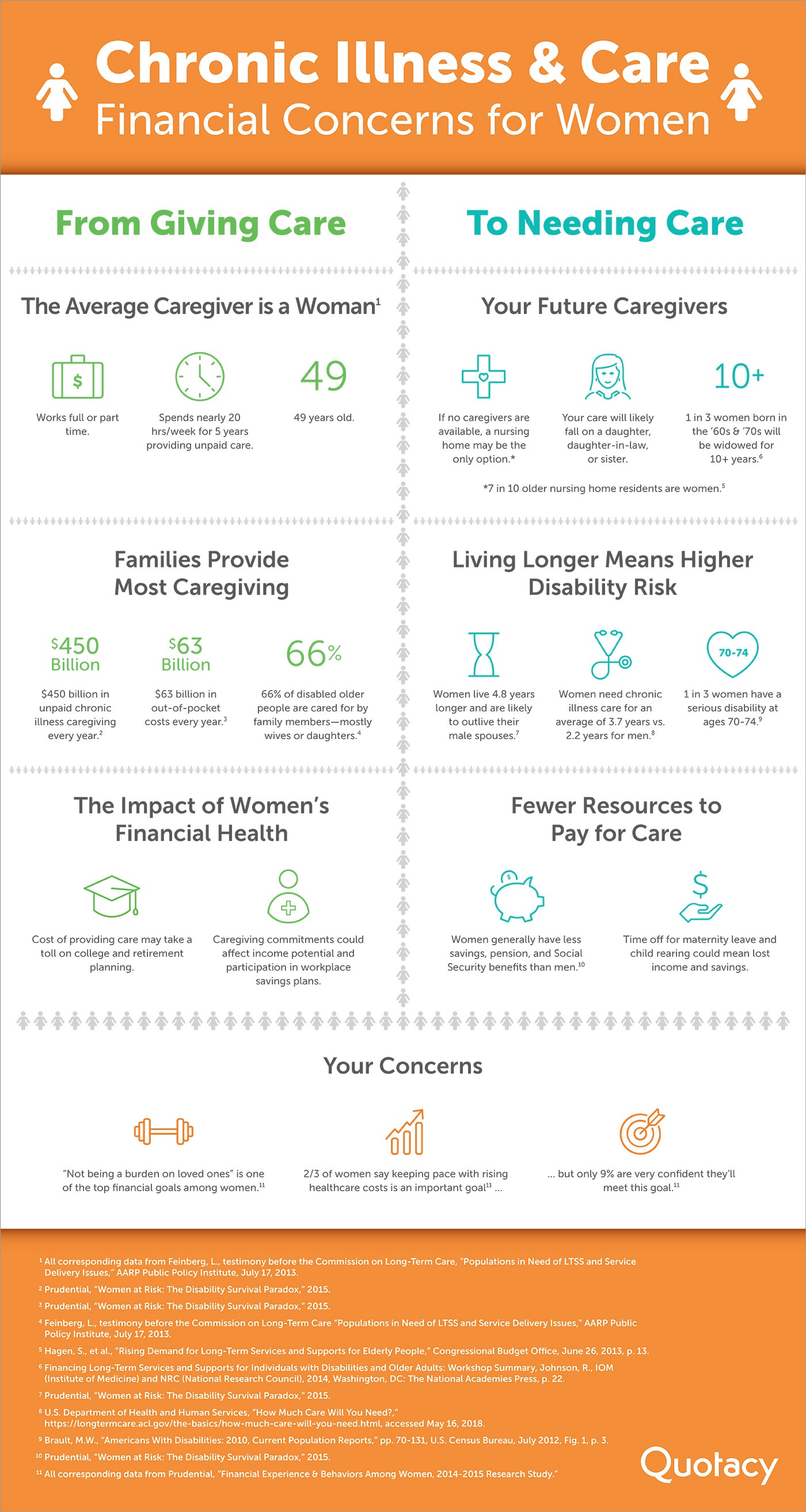

- Women are more likely to take career breaks for caregiving, such as raising children or caring for aging parents. Time away from the workforce can have significant financial implications such as:

- Lost income

- Lost employer benefits (e.g., health insurance, retirement benefits, etc.)

- Potentially lower Social Security retirement benefit

- Difficulty re-entering the job market

- Women typically earn less than men, affecting their ability to save and secure retirement benefits.

- Women tend to live longer than men, which presents its own set of challenges:

- Needing to stretch retirement dollars further

- Higher potential for needing long-term care

- Managing marital assets after a spouse’s passing

- Women generally invest more conservatively which leads to:

- Loss of purchasing power due to inflation

- Inadequate retirement nest egg

The pay gap isn’t the only gender-influenced financial gap. According to LIMRA’s Insurance Barometer Study, in 2022, less than half of American women (46%) had life insurance coverage. This is an important financial tool women should not procrastinate getting.

See what you’d pay for life insurance

Why Is Life Insurance Important for Women?

Life insurance holds significant importance for any woman who has dependents relying on her, regardless of being single, a primary earner, or a stay-at-home mom. Having a life insurance policy offers numerous benefits and securities, providing a safety net for loved ones. Let’s explore these advantages together.

Financial Security for Dependents

Life insurance is not merely a policy; it’s a financial safety net for your loved ones. Your income supports your family’s lifestyle. Should something happen to you, the life insurance payout can cover everything from day-to-day living expenses to long-term educational needs for your children.

More Affordable When Young

Life insurance premiums increase with age. The younger and healthier you are when you secure a policy, the less it costs you over the long term. It’s also important to note that women usually pay less for life insurance compared to men, so let’s take advantage of it.

Covering End-of-Life Expenses

Even if you don’t have dependents, life insurance can cover your funeral and end-of-life medical expenses. These costs can be a burden on your family, and having life insurance alleviates this financial strain during an emotionally challenging time.

Besides life insurance, have you considered other end-of-life preparations, such as creating a will or designating a power of attorney? Check out our guide, How to Prepare for Death: 7 Tasks You Need to Complete, to help you get started.

Accumulated Cash Value

Some types of permanent life insurance, like whole or universal life insurance, have a cash value component that grows over time. This can serve as a financial resource you can draw upon for needs like buying a home, supplementing retirement income, or emergencies.

Flexibility in Estate Planning

Life insurance proceeds are generally not subject to income tax, and with proper planning, they can also be kept out of your taxable estate. This makes life insurance a versatile tool in estate planning, enabling you to pass more wealth to your heirs and favorite causes.

Partnering with Investments

For those with more substantial assets, life insurance can work in tandem with investment strategies. In some cases, the benefits from a life insurance policy can provide a tax-advantaged way to transfer wealth or support philanthropic endeavors.

Future Health Concerns

While no one likes to think about declining health, securing life insurance while you’re healthy is easier and more cost-effective. Many conditions can make you ineligible for life insurance or significantly increase your premiums.

Delaying the purchase of life insurance not only leaves you financially vulnerable but also potentially diminishes your future options. The importance of life insurance cannot be overstated.

The Cost of Life Insurance for Women

Women generally pay less for life insurance than men do. This is because women, on average, live longer than men. Insurance companies set their prices based on how likely someone is to pass away while the policy is active. Because women have a lower “mortality risk,” their premiums are usually lower.

Consider the table below. For the exact same life insurance policy, women pay a significant amount less than men.

Learn more about how gender plays a role in life insurance.

The Importance of Shopping Around

When you’re in the market for life insurance, it pays to compare different providers. Each insurance company evaluates health conditions in its own way. One may offer you a “Standard” risk class, while another might offer you a “Preferred” class for the same health profile. Your risk class directly affects the premium you’ll pay.

Consider the table below. The cost varies significantly based on what risk class the woman receives.

Health Conditions and Their Impact

Certain health conditions are more prevalent in women, including:

- Alzheimer’s disease

- Autoimmune diseases

- Breast cancer

- Cardiovascular disease

- Chronic pain

- Depression

- Diseases of the lung

- Gastroenterological problems

- Lupus

- Migraine headache

- Mood disorders

- Multiple sclerosis

- Rheumatoid arthritis

Each of these diagnoses can impact your life insurance rates depending on the severity of the condition. The silver lining is that Quotacy can help you find the insurance company that will be most lenient with your specific risk factors.

Special Cases Like Pregnancy

If you’re pregnant, your current weight might be considerably higher than your usual weight. Some insurance companies only focus on your current weight when determining your rates, which could result in higher costs. Quotacy can guide you to an insurer that takes into account your weight history, possibly helping you save money.

Not sure how much term life insurance you need?

How Quotacy Helps You Get Free Quotes and Compare Policies

As an independent broker, Quotacy works with multiple insurance companies to give you a variety of policy options. You don’t need to read through fine print or apply to multiple places to find the best deal. Quotacy does this work for you behind the scenes.

You can obtain free life insurance quotes on our website without giving away any contact details. When you’re picking a policy, don’t stress. We’ll verify that you’re aligned with the most suitable insurer.

Application Review by Your Agent

After you complete your online application, your dedicated agent will review it before forwarding it to the insurance company you’ve selected. If everything looks good and no risk factors stand out, your application will be processed. Should there be any concerns, your agent will reach out to discuss them with you.

Your Choice, Your Policy

Remember, you have the final say in selecting your insurance provider. Your agent’s role is to guide you, answer your questions, and make recommendations. Our agents don’t work on commission, putting your best interests first.

Take charge of your family’s financial future with life insurance. Whether you’re earning outside the home or are a stay-at-home parent, consider the financial gap that would be left if you were to pass away suddenly. While life insurance can’t replace you, it provides a financial cushion for your family during a challenging time.

Note: Life insurance quotes used in this article are accurate as of November 22, 2023. These are only estimates and your life insurance costs may be higher or lower.

0 Comments