Your policy’s term length plays a pivotal role in ensuring your loved ones are financially protected no matter what. Naturally, this begs the question, “How long should term life insurance actually last?”

In this blog, we’ll show you how to determine the right term length for your personal and financial needs, and the easiest way to get term life insurance quotes.

Table of Contents

- How Long Can Term Life Insurance Last

- How Long Should Your Term Be

- What Are Your Term Insurance Options

- How Much Term Life Insurance Do You Need

- What Is Your Realistic Long-Term Budget

- What If You Need More Life Insurance

- How Are Your Costs Determined

How Long Can Term Life Insurance Last?

Term life insurance is typically sold in lengths of 10, 15, 20, 25, 30, 35, or 40 years. This duration of time is the “term”. Once the term is over, your coverage terminates.

What Term Lengths Are Most Common?

Age and life stage determine when you should get life insurance and how much you need. Depending on your age, you can choose a term length between 10 and 40 years.

Here are some example scenarios for different term lengths:

- If your children will enter college in a few years and you want to protect them from having to take on student loan debt if you pass away.

- If you are a few years from retirement and you want to provide security for your partner’s retirement years.

- Newlyweds or new parents that want to protect their growing family.

- If you are a young family and you wish to safeguard your children’s financial future until they become independent.

- If you want to protect your family’s estate from long-term business debt that you personally guaranteed.

- If you don’t yet have children but plan to.

- If you plan to pay off a newer mortgage should you pass away.

- If you want to leave funds to pay for your young grandchildren’s college education.

- If you’re young and want coverage to last until you’re in your retirement years.

- If you’ve been thinking about permanent life insurance but it’s out of your budget.

- If you have debt that may take awhile to pay off and don’t want to leave any behind to your family.

Because life changes as time goes on, you may find your coverage needs change over time as well. We recommend reviewing your policy at least once a year to ensure it’s adequate.

How Long Should Your Term Be?

The length of the term insurance policy that’s right for your family depends on your short and long-term financial goals. Let’s explore some common scenarios.

Goal #1: Income Replacement

Term Length Suggestion: coverage until retirement age.

Income replacement is the most common reason for people to buy term life insurance.

Your policy should cover your working years and expire once you reach retirement.

Should you die unexpectedly during those prime earning years, the life insurance policy replaces the income you were providing to your family.

Many financial advisors recommend purchasing coverage that is ten times the equivalent of your current income. While that may be a good starting place to evaluate your needs, we don’t recommend using that exact method. Ten times your income may be too much or too little depending on factors such as:

- Are you married?

- Are you a business owner?

- Do you have children? Do you plan to cover college costs?

- Do you care for a child or loved one with a disability?

- Do you have a mortgage?

- Do you have student loans?

- Do you have other inheritable debt?

- Do you have elderly dependents?

- Do you want to cover your end-of-life expenses?

Your needs are based on what you want for your family or anyone else who depends on you financially.

Take a deeper look at your how much coverage you should have and how long you’ll need it with our free term life insurance calculator.

Goal #2: Long-Term Financial Support for Loved Ones

Term Length Suggestion: the longest term you can afford.

Another important part of deciding how much term insurance makes sense for your family is to decide what type of support that you want to provide for your loved ones.

Here are some questions to consider:

- Do you want to contribute to, or pay, college education costs for your children?

- Will your children depend on you financially into adulthood?

- Do you want to support your partner or an elderly relative once they’re out of the workforce?

If you plan to help pay college tuition, then you’ll want to consider future education costs (which are on the rise) to protect your children from the crushing burden of student loan debt.

Whether your kids go to college or not, 18-year-olds are generally not yet financially independent. Furthermore, once they’re independent, do you want to help pay for a wedding or a down payment on a house?

Finally, planning to provide for loved ones into their retirement and beyond (nursing home, hospice care, etc), you’ll need to account for those costs, as well.

Goal #3: Debt Repayment

Term Length Suggestion: equal to or greater than your longest financial obligation

If you have inheritable debt that you don’t want to leave behind or a mortgage that your family can’t afford without you, add these amounts to your coverage needs.

Examples of debt that you might want to repay include:

- Mortgage

- Car loans

- Credit card debt

- Private student loans

- Business debts that you personally guaranteed

- Healthcare bills

Your term length should last as long as your longest term financial obligation. So, if your mortgage loan is a 30-year term then you should choose a life insurance policy with a 30-year term.

These goals aren’t mutually exclusive. Depending on your family’s needs, all of these may already be included in your financial plan.

Try our free quoting tool to see what you could pay for term life insurance without giving up any contact information.

What Are Your Term Insurance Options?

There is no rule against owning more than one life insurance policy. In fact, owning multiple policies with different term lengths is an excellent cost-saving strategy known as laddering.

For example, say your largest debt is your mortgage. The loan balance is for $250,000 and it’s a 15-year term. Taking this into consideration, you probably only need a 15-year term policy, right?

Well, let’s also say you have three children ages nine months, two years, and three years. You and your spouse plan on paying for their college tuition. Your youngest won’t graduate college for at least 21 years.

So, let’s think about this. You know you want protection of at least $250,000 for 15 years (the mortgage). And according to the Education Data Initiative, the average cost of a public four-year in-state college in the U.S. is $35,331 per student per year (including tuition, books, supplies, and daily living expenses).

Sending three children to college to obtain their bachelor’s degrees will cost approximately $450,000 total. You’ll want this amount of protection for at least 20 years since your youngest is less than one.

You could purchase one policy with a coverage amount of $700,000 and term length of 25 years OR you could purchase two policies—one with a coverage amount of $250,000 and term length of 15 years and a second one with a coverage amount of $450,000 and term length of 25 years.

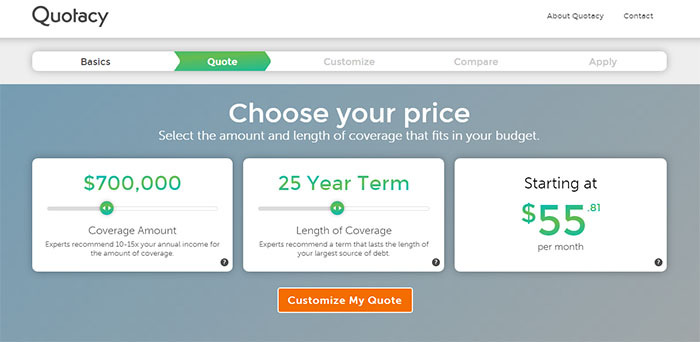

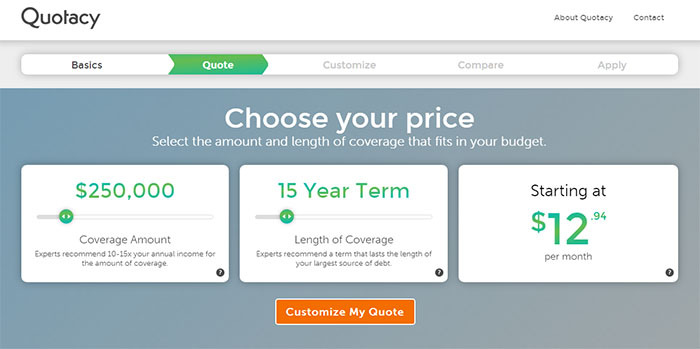

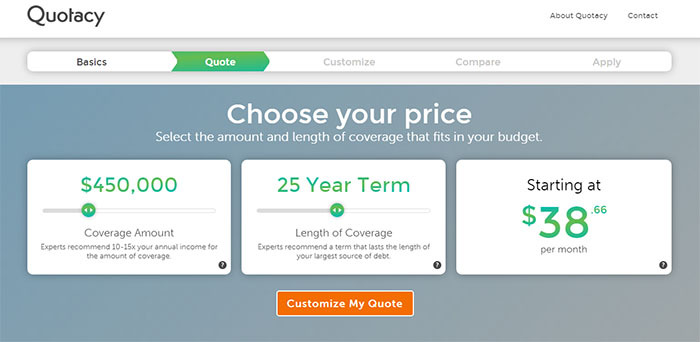

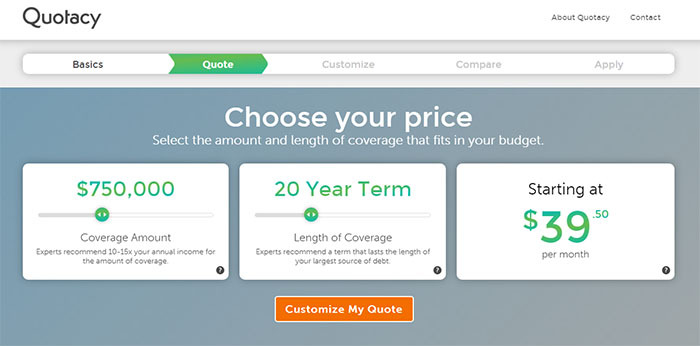

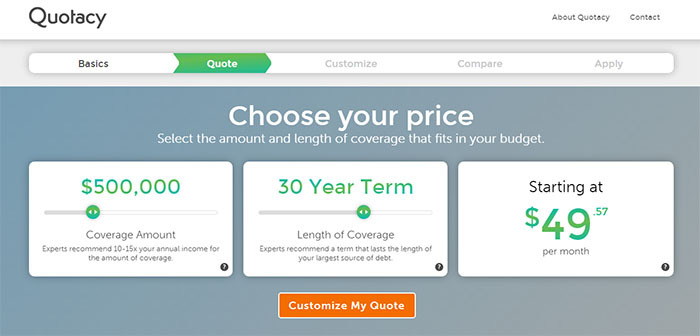

Consider the screenshots below. They are quotes for a healthy, non-smoking, 40-year-old male.

Option 1: One Policy – $700,000 Life Insurance Policy with a 25-Year Term

Option 2: Laddering Two Policies – $250,000 Life Insurance Policy with a 15-Year Term and $450,000 Life Insurance Policy with a 25-Year Term

As you can see, laddering the two policies would save you a few dollars each month. And after 15 years, that savings really adds up.

Option 1: Pay $55.81 per month for 25 years.

Option 2: Pay $51.60 per month for 15 years, then $38.66 per month for remaining 10 years.

If you went with Option 2 to ladder the policies, after 15 years, the first policy would expire and you would no longer be paying for coverage you don’t need since your mortgage is now paid off. But you would still have the back up 25-year term policy to financially protect your family for another 10 years.

How Much Term Life Insurance Do You Need?

When buying life insurance, you have to decide how long it should last and how much coverage to buy. The answer to how much term insurance you need depends on what you want for your family, which may change as time goes on.

Still, it’s wise to answer a few important questions about your current and planned expenses when determining how much coverage you should purchase. Here are a few questions to help you get started.

What Are My Fixed Monthly Household Expenses?

These may include:

- Mortgage or rent payments

- Loan payments (such as student loans at a fixed interest rate)

- Health insurance premiums

- Vehicle insurance premiums

- Car payments

- Membership fees (fitness clubs, etc)

- Children’s school fees and expenses

How Much Are My Variable Household Expenses?

These will include:

- Food

- Utilities

- Credit card debt

- Average transportation costs (vehicle fuel, public transportation passes)

- Entertainment

- Clothing and incidental purchases

In addition to the above, there may be some one-time (or infrequent) large expenses that may be a part of your short or long-term financial plan. These may include:

- Renovating your home

- Purchasing a new or second home

- Buying a new vehicle

- Contributing to a retirement fund

- Creating a trust fund for a child or other family member

- Starting a business

Certainly, you don’t have to have precise amounts for all of the items above, but it is good to have some ballpark figures in mind as you think about how much term insurance coverage you will need to secure your family’s future.

Another important consideration when purchasing term insurance is your current budget.

What Is Your Realistic Long-Term Budget?

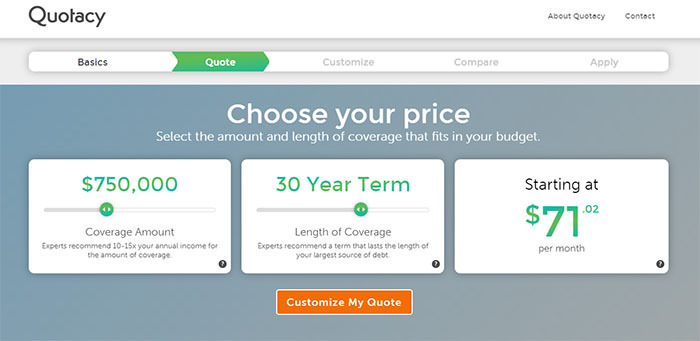

Term life insurance is ideal for most individuals because it can be customized to fit most budgets. For example, if you want a 30-year term policy with a coverage amount of $750,000, but don’t believe you can afford to keep up with the premiums long-term, then consider instead a smaller coverage amount or shorter term.

Consider the options below. The quotes are for a healthy, non-smoking male applicant who is 40 years old.

Option 1: $750,000 Life Insurance with a 30-Year Term

Option 2: $750,000 Life Insurance with a 20-Year Term

Option 3: $500,000 Life Insurance with a 30-Year Term

If you’re looking to lower your premium costs, which option do you choose? Lower the coverage amount or shorten the term? The right option really depends on your situation.

For example, if your mortgage loan is a 15-year term and your children are over the age of 10, then going with the 20-year term over a 30-year term is a logical choice. On the other side of the spectrum, if your children are still in diapers, then lowering the coverage amount and sticking with the 30-year term is probably the wiser choice.

Buy what you can afford. Some life insurance is better than no life insurance at all.

What If You Need More Life Insurance?

At the end of your term, coverage will end and your payments to the insurance company will be complete. If you outlive your term life insurance policy, the money you have put in, will stay with the insurance company.

However, if your coverage is ending soon and you realize you need coverage to continue, you have some options:

- You can renew the term

- Convert it into a permanent policy

- Choose to buy a new policy if you’re still insurable

How Are Your Costs Determined?

The success of your application and the amount you will pay in premiums depends on a number of factors. These include:

- Age

- Gender

- Employment (if you are in a dangerous profession, such as working in construction, your premiums will be higher)

- Personal and familial medical history (if you have survived a catastrophic illness, or have a family history of serious diseases, then you may pay more in premiums)

- Current health

- Smoking status

- Driving status (a record of consistently unsafe driving will impact your premiums)

- Hobbies (if you love cliff-diving or other risky hobbies, expect an elevated premium)

- Frequent international travel—such as for work or volunteering that involves traveling to areas that are listed as potentially dangerous by the State Department—will likely make your premiums higher than average.

Don’t let the list above intimidate you. Insurance companies need this information to determine your risk level and costs, but don’t hesitate to apply because your record isn’t perfect.

Companies evaluate risk differently from one to the next. Quotacy agents are deeply familiar with how each of our carriers evaluate risk, and which will be most lenient with your unique risk factors.

Note: Life insurance quotes used in this article accurate as of June 22, 2022. These are only estimates and your life insurance costs may be higher or lower.

0 Comments