A $500,000 policy is a commonly purchased amount of term life insurance. It’s often enough to pay off a mortgage, help cover children’s college education costs, and pay for final expenses.

How much is a 500K life insurance policy? It’s likely more affordable than you think. People often overestimate the cost of life insurance.

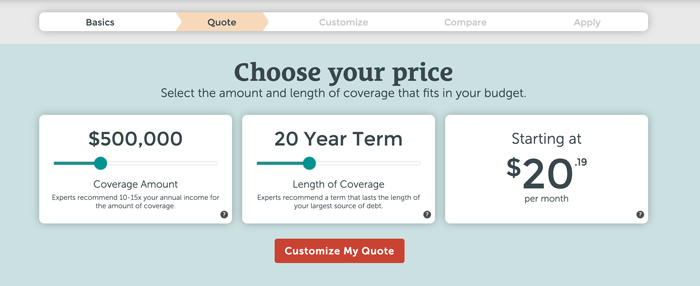

Get an instant quote for $500,000 of term coverage instantly using our free quoting tool. No need to give away any contact information in order to see real-time pricing estimates.

Table of Contents

- Can Anyone Get a $500,000 Life Insurance Policy?

- When Does a $500,000 Life Insurance Policy Make Sense?

- How Much Does a $500,000 Life Insurance Policy Cost?

- Can I Buy $500,000 Without a Life Insurance Medical Exam?

To answer these questions, let’s take a closer look at some scenarios and example pricing for different age groups, genders, and term lengths.

Learn more about term life insurance and how it works in our guide.

Can Anyone Get a $500,000 Policy?

When you apply for life insurance, companies need to verify that the amount you’re asking for makes financial sense. Insurance providers typically use a formula that multiplies your annual income by a certain factor, which varies depending on your age, to determine the maximum coverage you can qualify for.

If the coverage you’re seeking is less than this calculated maximum, you’re generally good to go.

However, this isn’t a strict rule. Approvals are determined on a case-by-case basis and might be influenced by other factors like business ownership or educational expenses, which could potentially allow for higher coverage.

It’s also important to understand that these guidelines consider your total life insurance coverage. If you already have a policy and want to keep it, this could affect your eligibility for an additional $500,000 in coverage.

When Does $500,000 of Coverage Make Sense?

A $500,000 term life insurance policy makes sense in many scenarios. If something were to happen to you, this amount would provide financial support to your loved ones.

The house your family lives in is often both the largest asset you own and your biggest source of debt. If you plan to pay for your child’s college education, that’s another significant expense to consider.

- According to research done in 2023, the average mortgage debt per U.S. household is $236,443.

- The total estimated cost to send one child to an in-state college for 4 years is $158,291.

With these figures in mind, a $500,000 life insurance policy could cover key financial goals like owning a home and paying for college. It can also help manage any end-of-life expenses, such as medical costs and funeral arrangements.

How Long Should a Term Life Insurance Policy Last?

When choosing the term length for a life insurance policy, it’s important to align it with the duration of your most long-term financial commitment.

For many people, this could be the length of their mortgage. For others, it might be the number of years until their youngest child is financially independent.

Using Quotacy’s quoting tool makes this decision easier. The tool is user-friendly and allows you to see pricing instantly without requiring any personal contact information. You can also adjust the coverage amount and term length to see how these changes affect your quote before submitting an application.

How Much Does a $500,000 Life Insurance Policy Cost?

The cost of a life insurance policy is determined by a number of factors, including:

- Gender

- Age

- Health status

- Policy type

- Coverage amount

- Term length

- And more

A $500,000 term life insurance policy is often an affordable option.

Let’s take a look at the cost of a $500,000 policy based on age and risk class. Term length options vary from 10 to 40 years, but the most common are shown below.

Explore average monthly life insurance costs for all policies.

See what you’d pay for life insurance

Can I Get a $500,000 Life Insurance Policy With No Exam?

Yes, it’s possible to get a $500,000 life insurance policy without undergoing a medical exam. Many of the insurance providers we work with here at Quotacy have no-exam options up to $1,000,000 of term life insurance coverage.

In most cases, you’ll need to be in good health to qualify for no-exam policies. However, insurance companies have different underwriting guidelines, so some may have more relaxed requirements. If you’re interested in skipping the medical exam, your agent can guide you through your options and help determine if you’re eligible.

Get a Term Life Insurance Quote Today

If something happens to you, term life insurance will financially protect the loved ones you leave behind. You can take pride in knowing you’re shielding them from financial harm should you die unexpectedly.

A $500,000 life insurance policy is one of the most commonly purchased amounts, but it may not be the right amount for you.

Our life insurance needs calculator can help you determine the right amount of coverage you need.

If you prefer to talk with an advisor to determine how much life insurance you need, contact us directly here at Quotacy. Our agents are happy to go over your needs and won’t push you into buying coverage you don’t need.

Note: Life insurance quotes used in this article are accurate as of November 6, 2023. These are only estimates and your life insurance costs may be higher or lower.

0 Comments