A life insurance medical exam is a simple physical exam that helps the insurance company determine its risk in insuring you. Not every applicant will be required to get a medical exam, but most will.

We understand the uncertainty surrounding the medical exam. After all, who looks forward to a physical? In this guide, you’ll learn what the life insurance medical exam consists of and how to best prepare for it.

What to Expect at the Life Insurance Physical

The life insurance medical exam (some refer to it simply as a physical) is a part of the underwriting process, and it’s free to you. The examiner—an independent contractor not employed by the insurance company—will come to your home or office, wherever is most convenient, at a date and time you choose. The exam typically takes about 15-30 minutes.

The routine physical you get at your doctor’s office doesn’t test for the same things the life insurance company underwriters look for, such as the health of your pancreas. This is why a life insurance medical exam is done by an independent examiner, not your doctor. Here’s an overview of what you can expect at your life insurance physical.

Interview

During the examiner interview, they’ll review your medical history with you to ensure there are no discrepancies between the answers you give and what you provided on your application. Be prepared to provide contact details for your doctors.

Physical Exam

The physical exam includes:

- Recording your height and weight

- Measuring pulse and blood pressure

- Taking blood and urine samples

If you’re older and applying for a large amount of life insurance coverage, an EKG and/or chest x-ray may be requested. A cognitive test may be performed for older individuals as well.

This information gives the insurance company a good overview of your current health. It will help determine your risk class, which defines how your policy rate is calculated.

If your health is better than the average person in your age group, you get a better risk class which means you pay less. If you’re average, you’re assigned a Standard risk class. If you’re less healthy than the average person, you’ll pay more for life insurance coverage.

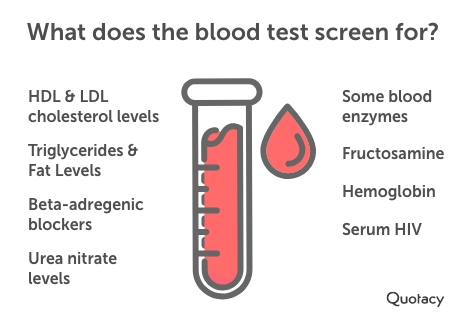

What Does the Life Insurance Blood Test Screen for?

A blood test can reveal a lot since the health of a person’s circulatory system can indicate a person’s risk of early death from heart disease.

A blood sample is also screened for things like:

- Both HDL and LDL cholesterol levels

- Triglycerides and fat levels

- Beta-adrenergic blockers enter the blood if the subject uses certain medications to treat arrhythmia, high blood pressure, or other heart defects

- Urea nitrogen levels, which many doctors use as a benchmark for evaluating how well your kidneys are removing waste from your body

- Certain blood enzymes like alkaline phosphatase and alanine aminotransferase, which doctors screen to check for liver and bone diseases, and for heavy alcohol consumption

- Fructosamine, which is a type of carbohydrate that tells doctors about your blood sugar patterns over the past 2-3 weeks

- Hemoglobin A1C levels, which give doctors an idea of your blood sugar over the past 90 days, and helps them screen for pre-diabetes and diabetes

- Serum HIV, which detects the human immunodeficiency virus that can lead to AIDS

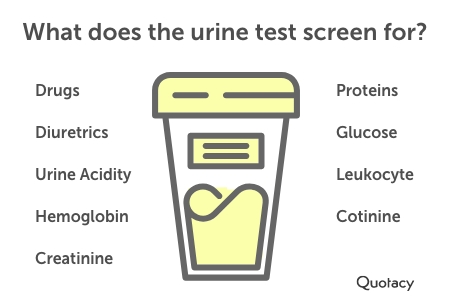

What Does the Life Insurance Urine Test Screen for?

A urinalysis can reveal the health of your body’s digestion and filtration system. A urinalysis is also, essentially, a life insurance drug test.

Other things a urine test can measure include:

- Diuretics, which can enter the urine as a result of taking high blood pressure medication

- Urine acidity, which, if outside of the standard 4 and 8 pH range, might point to kidney issues, obesity, diabetes, and an unhealthy diet

- Hemoglobin, which would point to kidney issues or urinary tract infections

- Creatinine, an excess of which suggests the presence of kidney disease

- Proteins such as microalbumin can also point to kidney disease

- Glucose, high levels of which suggest pre-diabetes or diabetes

- Leukocyte esterase, an enzyme that might point to infections of the kidney or bladder

- Cotinine, which enters the bladder if the subject uses tobacco or other nicotine products

Learn more about getting life insurance with a pre-existing condition.

Tips to Help You Pass Your Life Insurance Medical Exam

Schedule the life insurance medical exam at a date and time that’s convenient for you, but consider these tips before you lock in the date.

- Schedule Your Exam in the Morning: It’s recommended that you avoid caffeine, working out, unhealthy foods, alcohol, and tobacco before your exam. To make this easier on yourself, just get it over and done with in the AM.

- Don’t Schedule an Exam When Menstruating: For women who menstruate, plan ahead and avoid having your medical exam during your period, if possible. If this comes up after you’ve scheduled the exam, simply contact your agent or examiner and ask to reschedule for a later date.

- Prepare Your Documents: The examiner will ask for your personal identification, the contact information of your doctors, and a list of any medications you’re taking. To speed up your exam, gather this information ahead of time.

- Let the Examiner Know if You’re Anxious: If you’re anxious about what may happen during your medical exam, talk to your examiner. They may note your fears in your file should your nervousness lead to high blood pressure results. These notes may be taken into consideration by the insurance company underwriter.

See what you’d pay for life insurance

How to Prepare for a Life Insurance Medical Exam

Your exam results play a significant role in what your policy will cost. Here are some actions you can take to prepare for the life insurance medical exam.

Weeks Before the Exam

Some changes to your diet and lifestyle leading up to your exam can help improve your results.

- Eat healthily. Limit your salt and fatty foods, and increase your greens. Taking these steps can help improve your blood pressure and cholesterol readings.

- Reduce alcohol. Drinking more than a moderate amount can raise blood pressure and affect liver enzymes.

- Increase water intake. If you’re not drinking 64 ounces of water daily, try to drink more. It’s the best way to flush your system and maximize your body’s general physical performance.

- Avoid drug use. Testing positive for drug use isn’t going to reflect well on your application. Even though some insurance companies are lenient with marijuana use, it’s best to avoid using drugs leading up to a life insurance medical exam.

Day Before the Exam

Making changes in the weeks leading up to your exam can be helpful, but if they seem too daunting, at least do your best to follow the following tips 24 hours prior.

- Get a good night’s sleep. When you are well-rested, your blood pressure is lower. Sleep also helps offset anxiety and fear.

- Don’t drink alcohol. Alcohol can increase your blood pressure. High blood pressure is one of the most common reasons someone does not qualify for the best rate class. Alcohol also dehydrates you, making it harder to draw blood during the exam.

- Don’t use tobacco. Nicotine also raises your blood pressure.

- Avoid OTC medications and nasal decongestants. Nasal decongestants and over-the-counter medications, such as antihistamines and ibuprofen, can increase blood pressure. And cold medicines can trigger a false positive for opiate use.

- Drink plenty of water. This will help clean out toxins in your blood and urine samples.

- Avoid poppy seeds. Skip the poppy seed muffin or bagel. Ingesting poppy seeds can lead to a false positive for opiates.

Day of Exam

Here are the tips to follow on the day of your life insurance medical exam for the best results.

- Avoid exercising. This may sound counterintuitive for an exam about your health but skip your routine workout. Strenuous exercise can raise both your pulse and blood pressure. If your exam is in the morning, skip working out the evening prior.

- Avoid caffeine. Skip your morning coffee, as it can elevate your blood pressure.

- Drink water. Drink a glass of water or two before your exam. Drinking water before a blood pressure test can help lower sodium levels but don’t overdo it. Too much water may dilute your urine, and you’d have to do the physical again.

Make sure you get the right policy with the right amount of coverage. Get a free term life insurance quote and compare prices today.

Find the Perfect Life Insurance Policy with Quotacy

Don’t be nervous about the life insurance health exam. Even if you have some medical problems, chances are you can get life insurance coverage.

Work with an independent life insurance broker to ensure you get the best rates. Quotacy, as a broker, offers products from over 20 of the nation’s top life insurance companies.

When you apply through Quotacy, your agent will review your application before officially submitting it to the insurance company. If you have a medical condition that one insurance company may be more lenient toward than another, your agent will explain these options to you.

The ability to shop the market for our clients is one of the best benefits of working with Quotacy. You can buy confidently knowing you’re getting an excellent policy and paying the best possible rate.

Still not ready to apply? Learn more about buying life insurance wisely in our step-by-step guide.

Hi all.

This is Doan Nguyen I copied that I know ,no food only water will seen you on Saturday Mar-10/2018

Thank you.

Regards.

Doan Nguyen.

Hi Natasha,

Thanks you sharing such informative blog. That was really great tips for everyone.